Save Money and Strengthen Your Benefits with a Section 125 Plan

5 Article

Lower your payroll costs and put more take-home pay in your employees’ pockets

Running a business means balancing the bottom line with providing the best possible benefits for your employees. That’s not always easy—especially when healthcare costs continue to rise. But there’s a simple way to lower your tax burden, help your employees save money, and add extra value to your benefits package: a Section 125 Premium Only Plan (POP) from Blue Cross and Blue Shield of Kansas (BCBSKS).

What is Section 125?

Section 125 of the IRS tax code allows employers to set up what’s called a Premium Only Plan (POP). With a POP plan, employees can pay their share of health, dental, vision, and prescription premiums with pre-tax dollars.

That means less taxable income for your employees, and less payroll tax liability for you. Everyone saves:

- Employees save 20–40% on their premium contributions through reduced federal, state, Social Security, and Medicare taxes.

- Employers save up to 8% on every dollar run through the plan by lowering payroll and FICA tax liability.

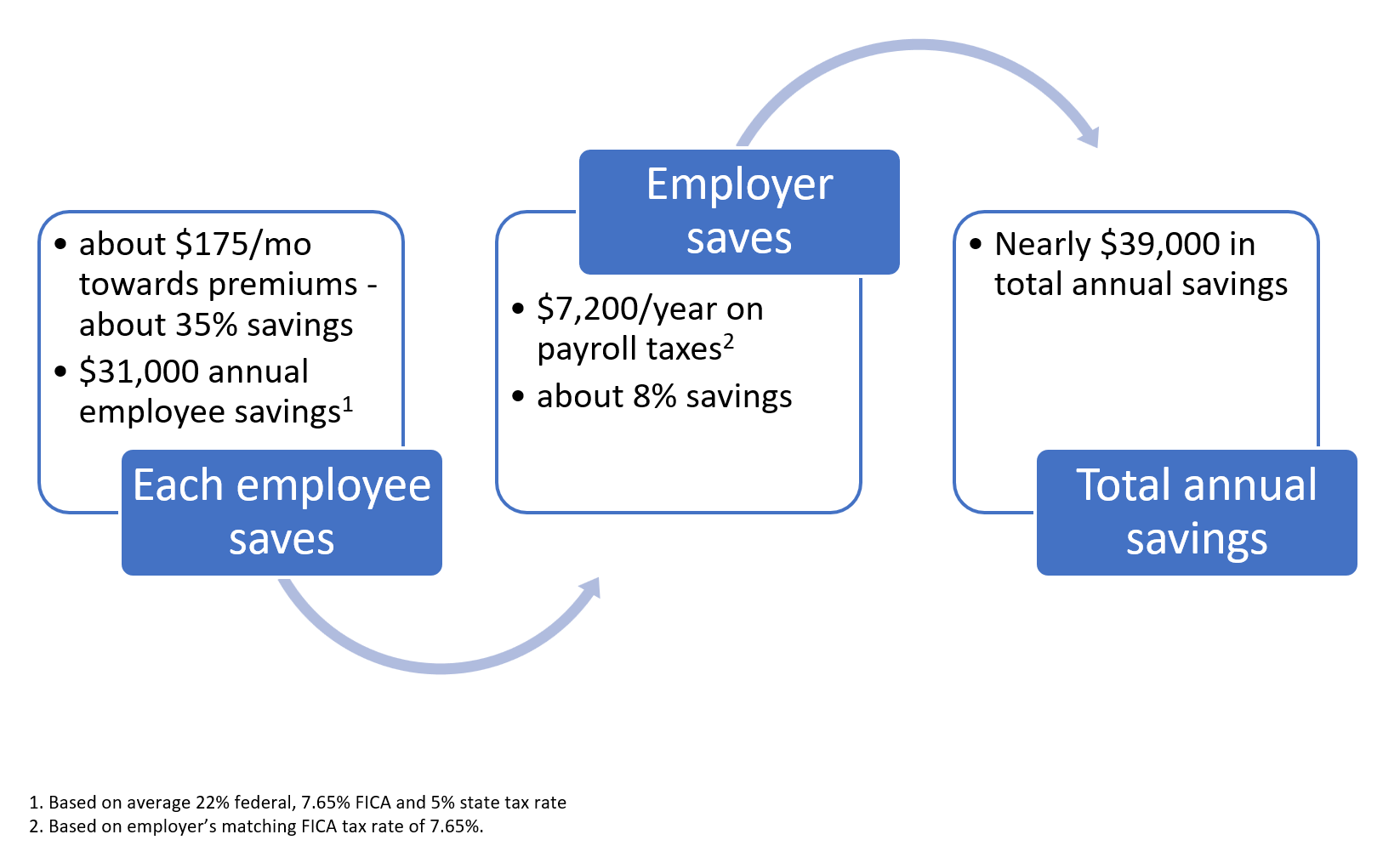

Real savings in action: money in your employees’ pockets—and more room in your business budget.

Here’s an example of how those savings add up for an employer with 15 employees each contributing $500 a month toward premiums.

Easy to set up, simple to maintain

With BCBSKS, getting started with a Section 125 plan couldn’t be easier. Once you set it up through payroll, it requires very little maintenance. Premiums are structured by company size, starting as low as $275 for employers with fewer than 15 full-time employees.

An annual maintenance fee keeps the plan compliant. For fewer than 15 full-time employees, the fee is $50. Employers with more than 15 employees will pay $100 per year.

No matter the size of your organization, Section 125 is designed to fit and deliver savings.

Why partner with BCBSKS?

At BCBSKS, we understand the challenges employers face. You want to provide great benefits, but you also have to watch costs carefully. That’s exactly where we can help.

- Local expertise: As a Kansas-based insurer, we know the needs of local businesses and their employees.

- Trusted partner: We provide members convenient access to care through our extensive provider network, help coordinate their care, and partner with community organizations to promote health across Kansas

- Seamless process: From setup to compliance to ongoing support, BCBSKS makes it simple to manage your health plan and Section 125 arrangement.

- Employee value: By lowering employees’ tax burden, you’re giving them more take-home pay without increasing salaries.

Ready to start?

Talk with your Blue Cross and Blue Shield of Kansas representative to learn more.

Connect with us today. Call 866-584-0171 or email [email protected].